Aftersales can skyrocket dealerships’ revenue! Here’s how in our previous blog post we went into detail about the rising customer expectations. On the car manufacturers’ side, they invest massive amounts into creating and marketing high-tech car models. Players in the ecosystem must keep up with the new models. The final spotlight is on the dealers who actually sell the cars. There are still a lot of untapped opportunities in the later phases of a car owner’s journey. In our new post, we will unravel the lesser mentioned golden egg, the aftermarket sales. We asked an expert in the field, Finn Daugaard. He has 20 years of experience as an aftermarket sales manager.

Traditional combustion engine cars are still here (and on the rise)

Despite the emerging trend of sustainability and shared mobility, traditional cars still dominate although at a bit slower pace, by 2% by 2030. On the contrary, used car sales rise because of the reduced average age of vehicle ownership. It is expected to grow 8.7% annually in the upcoming 10 years, and that is an impressive number! It is clear that as the share of older vehicles grows, OEMs need to look further. Beyond new car sales and become more involved in the traditional fields, such as the aftermarket. Dealers are no exception to this. This is the most important strategic place where they sell cars and have customer touchpoints.

The key for dealerships’ revenue maximization: used cars & aftersales

Up until this day, there is an imbalance in the focus that sales and aftermarket sales get in a dealership. Sales targets are set and every month the race starts. There is a lot less focus on behind the scenes, and that is car maintenance. It is an important fact that gets less focus from dealers. The older the car gets the more revenue it generates. According to National Automobile Dealer Association, the majority of dealerships’ gross profit comes not from sales but from aftermarket sales, namely 49.6%.

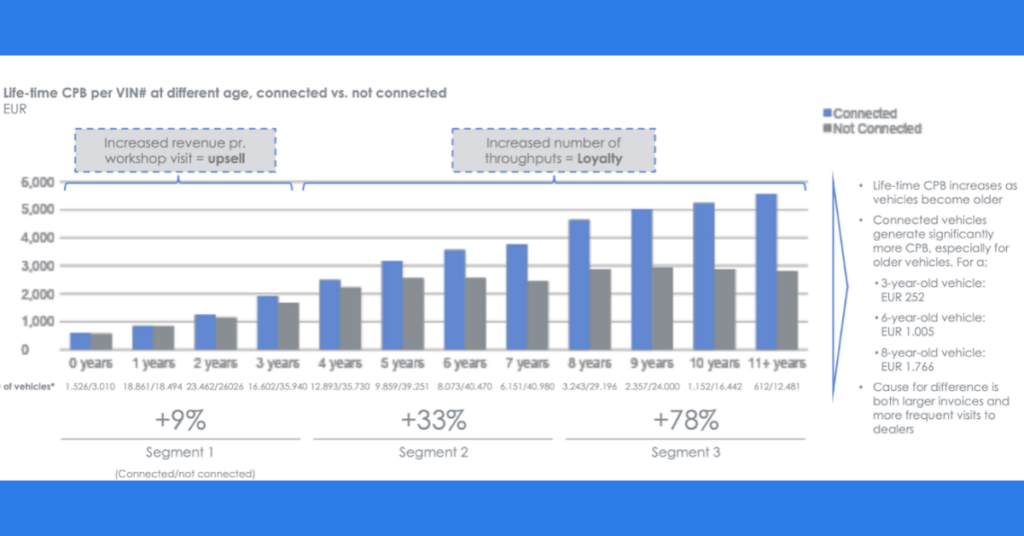

We already have actual data that proves that a connected used car can maximize revenue made per car. Vehicles older than 8 years, can generate 78% more revenue than those cars that are not. On the other hand, spare parts turnover is a lot higher also when a car is connected, so it is a win-win both for the dealers and for the OEMs/importers. The question is, why is there less focus on the customer after the deal is done? It’s quite obvious that used cars are a gold mine and need way more attention.

What the expert says

Finn Daugård Peters is responsible for the aftermarket success of Autocentralen. It is Jutland’s (Denmark) biggest Volkswagen dealer with 7 locations. Finn who has a background in heavy machinery aftermarket sales and now working with passenger cars for almost 10 years, gave us great insight into pains and also the solution for it:

“Used cars are the core of my business, and it has the highest potential for profit generation, but compared to their value, it gets less attention when it comes to dealerships’ business strategy. I am fighting for it every day and there is still a lot to do, but the future is promising with new technology fostering customer loyalty.

Because, when I talk about used cars, I want to talk about customer loyalty and car loyalty from the dealership’s side. I want to take care of that used car, because that’s where the big profit lies. Customers on average buy a new car every 3,5 years according to the statistics but I am interested in the 4+ years old car.

Personally, I was fighting for many years for used cars. When older cars get out of my ecosystem it is a huge loss. We sell around 15.000 cars yearly (private, leasing, and company cars) but on every 100 sold private cars we end up with 20 good used cars. That was a disaster from my point of view. We should sell all the used cars that once we sold as new. Luckily, my organization has realized the potential in used cars and now we are going to sell them and do all the services as well. This is very, very important when it comes to dealerships’ revenue.

A lot better business case on used cars

In general, it is very difficult to make business on used cars if it’s not embedded well in dealerships’ sales strategy. On the contrary, you need a lot less manpower than new cars. When new cars are sold, you need one office man and two mechanics, and a lot of paperwork. For one used car one office man can handle more mechanics. The business case is much better on used cars because we deal with them in the same system: warranty handling, leasing, factory handling, service information, etc., and used cars need a lot more spare parts, and that’s where the business is.

We need customer and car loyalty. Not only to new cars but used ones too. We must be able to keep the customers and keep their used cars to then sell it ourselves and make its new owner loyal too. The aftersales is so important for dealers like us. If you take a helicopter view of it, you will see on almost every dealer in Denmark that ¾ of their profit comes from sales, and ¾ of the revenue comes from aftersales. Yet 90% of the budget goes to the marketing of new cars and little is left for the aftermarket. I witnessed the industry for a long time, it went through many changes but there is still a lot more money in after-sales as maintenance will always be a must. Strong aftersales is the best help you can give to your sales department, yet 99% of the personnel are sales people, and only a few are from aftersales.

I spent 25 years in the heavy and construction machinery industry and there’s a totally different view on it. Aftersales is the most important thing because you can’t get a 40-ton excavator just like that, and the car industry could learn so much if adopted from this point of view.

Connecting customers to workshops to ensure loyalty and more revenue

As I said, customer loyalty is what I won’t because it’s particularly important in aftersales. We’ve used Connected Cars at Autocentralen since the beginning and it has resulted in more revenue as customers become loyal to the system. We know customers are quite loyal in the first 2–3 years, mainly because of the repair and maintenance contract, and what happens after is where the profit lies for my segment. That’s where Connected Cars comes into the picture.

Its workshop management tool particularly solves the problem of customer retention as most leave workshops after the warranty has ended and without a good customer management system, we were simply unable to follow where customers fall off. Now we are able to turn the tables, be proactive and reach out to the customers ourselves.

We can just see the service lamps and necessary maintenance in the car, so we are able to contact the customer beforehand giving them a good service experience.

With this, we reduce the cost and the time both for us and for the customers. It’s very positive and it helps us a lot during Corona times too. We can actually see that there is higher revenue.

I’m fighting daily to educate the aftersales department on offering the solution for the customers, which costs nothing to them. Every dealership and manufacturer should consider connectivity. Every car made after 2008 should have connectivity. That’s where we can get the most out of a new car and a used car. So it seems a slow process, but something is definitely going on. It will eventually be fruitful in the near future. “

Conclusion

The aftermarket has a huge untapped potential and used cars need more attention. Aftermarket sales, car, and customer loyalty need more places to make dealerships stand out from the crowd.