The agency model represents a dramatic pivot in automotive retail, which casts dealerships into an uncertain future. This approach hands more control to manufacturers, thereby altering the long-standing dynamics among dealers, manufacturers, and customers. The autonomy dealerships once enjoyed over pricing, inventory, and customer interactions is being upended.

Now, with manufacturers at the helm, dealerships are transitioning from drivers to passengers. They are confronting changes that test their independence and existence. This shift necessitates a rethink of roles, strategies, and responses. Survival hinges on adaptability and resilience in this new landscape.

This article examines these profound changes, along with the forces driving them. It delves into the critical challenges dealerships face, and the opportunities for innovation and agility that arise. The journey forward is complex, but grasping the intricacies of this transition can prepare dealerships to steer through this uncharted territory.

The agency model: A new era in automotive retail

The automotive industry is at a crossroads, facing changes that stem not from the introduction of a new vehicle type, but from a fundamental restructuring in sales strategy: the emergence of the agency model. This tectonic shift doesn’t just modify the method of selling cars; it’s rewriting the entire script that defines the relationships between manufacturers, dealerships, and customers.

In the historical dealership model, autonomy was the name of the game. Dealerships acted as the crucial interface between manufacturers and consumers, purchasing vehicles at wholesale, setting retail prices, and managing inventory based on local market insights. However, this independence also led to inconsistencies in pricing and a fragmented customer experience across regions.

Manufacturers’ motivation: Control and consistency

The agency model ushers in a fresh era. In this setup, the power of pricing and inventory rests with the manufacturers, while dealers serve as brand ambassadors, reaping commissions on sales. This methodology borrows significantly from tech industry tactics, emphasizing uniform pricing and a homogenized purchasing journey for customers everywhere.

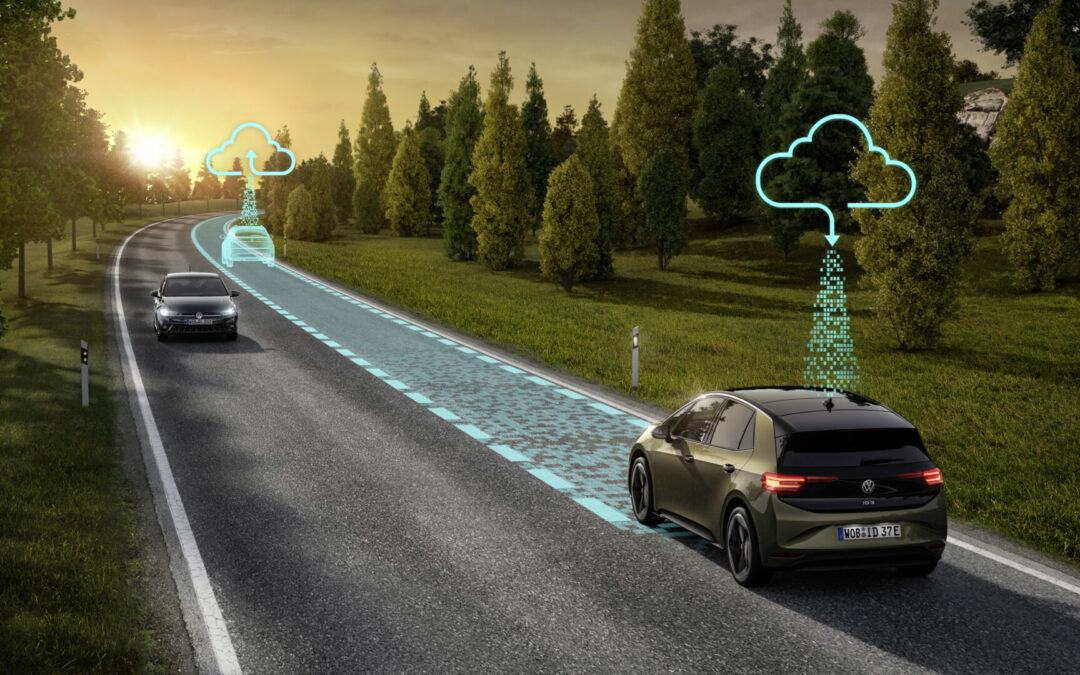

Propelling this transformation is the manufacturers’ quest for uniformity, brand cohesion, and a direct conduit to the customer base. According to Alex Smith, Managing Director of Volkswagen in the UK, this model facilitates a digitalized customer interaction concerning orders, pricing, and payments. On the flip side, the dealer handles the more physical aspects like test-drives and vehicle handovers. This digital-physical blend aims to optimize the sales process, maintaining the human touch where it matters most.

Dealerships in dilemma: Losing leverage

Dealerships find themselves cornered, relinquishing much of their sway in this new setup. The concern extends beyond losing control over pricing, focusing more on maintaining a strong customer connection. While this shift streamlines operations, it seemingly creates a distance, a sort of disconnect, between the dealerships and the communities they serve.

At the core of the contention lies data. In today’s landscape, data has become akin to currency. Manufacturers are engaged in a race to monopolize this wealth — a critical resource for refining services, tailoring user experiences, and potentially unveiling novel revenue avenues. The agency model serves as their key to this vault, centralizing data control at the manufacturers’ level.

For dealerships, this change emerges as a double-edged sword. It heralds a more streamlined, consistent approach, but simultaneously erodes their autonomy and disconnects them from local market dynamics. As these new currents take hold, the industry sails into uncharted territories. The future seemingly hinges on the adaptability and resilience of everyone involved.

The inevitable transformation: Dealerships bracing for change

The automotive retail landscape is not just shifting; it’s transforming in real-time. A study by Capgemini underscores this evolution, with a striking 80% of global retailers anticipating their roles changing to fit within the agency model framework. This isn’t a distant change on the horizon; it’s a wave that’s already crashing on the shore, and dealerships are feeling the impact.

This statistic is more than a number; it’s a sign of a tectonic industry shift. Dealerships, historically used to significant autonomy, are now recalibrating their operations, expectations, and perhaps most poignantly, their identity within the sales model. The transition to the agency model is not merely a change in sales tactics; it’s a fundamental evolution in the dealership’s role — from an independent entity to an extension of the manufacturer.

Operational autonomy at stake: The new dealership dilemma

Nonetheless, this transformation births critical questions and concerns. Should dealerships operate as agents of the manufacturers, what becomes of their expertise in tailoring services and sales to the local market? With the centralization of data control, pricing, and branding with OEMs, where does this position dealerships regarding their operational independence?

These concerns find reflections among dealership staff and industry experts alike. The dealership role has always been deeply rooted in community — understanding and addressing the unique needs of the local area, forming personal relationships with buyers, and providing tailored services. With the agency model, there’s a burgeoning concern that dealerships will lose these local touchpoints, which have not only been key to their business success but also a foundational part of their identity in the community.

A Regional Sales Manager at a prominent Swedish dealership chimes in: “We’re facing a reality where adaptability is not optional. It’s about finding ways to enhance the customer experience while navigating within the constraints set by manufacturers.”

Adapting to survive: The road ahead

Facing these sweeping changes, adaptation strategies are now front and center in boardroom discussions across the automotive retail industry. There’s a shared understanding that remaining anchored in old methodologies isn’t viable. Yet, there’s also a palpable apprehension about navigating uncharted waters where the rules are being written by someone else.

Navigating the principal-agent problem in automotive retail: Seismic shift in dynamics

The advent of the agency model in the automotive industry exacerbates the principal-agent problem. This situation arises where the interests of the two parties—principals (manufacturers) and agents (dealerships)—don’t perfectly align. In the past, dealerships enjoyed substantial autonomy, implementing strategies that catered to local market demands while also promoting the manufacturers’ objectives. However, the agency model dramatically shifts this balance, awarding manufacturers more control over pricing and inventory, thereby constricting dealerships’ flexibility and potentially leading to a misalignment of incentives and goals.

At the core of the principal-agent dilemma in this fresh landscape lies the differing motivations: manufacturers may prioritize global branding and uniform pricing, while dealerships need to respond to the unique nuances of their local markets. This disparity can foster conflicts, as a standardized approach may fall flat locally, and dealerships’ leeway in business operations is curtailed, potentially impacting their profitability and effectiveness.

Seeking balance in a new landscape

Addressing this principal-agent problem necessitates forging a new balance. This balance should consider the motivations and challenges of both manufacturers and dealerships. It’s about finding a middle ground, a place where manufacturers can maintain brand consistency, and dealerships can continue to thrive with some degree of operational flexibility. This process may involve rethinking success metrics, establishing incentive structures that align with both parties’ goals, and fostering open communication to nurture a more harmonious relationship.

As the industry evolves, creating this equilibrium becomes crucial. It extends beyond merely managing a shift in operational dynamics. It’s about ensuring that amidst these changes, dealerships can maintain their relevance and effectiveness. They should provide the level of service that customers expect, thereby upholding the integrity and success of the automotive brand as a whole.

Innovating to survive: The role of Connected Cars and advanced telematics services

The automotive industry stands on the precipice of change. Dealerships are grappling with the realities of the agency model, diminished access to customer data, and an altered relationship dynamic with consumers. However, amidst these challenges, connected car technologies and advanced telematics services emerge as potential game-changers. They empower dealerships to innovate and maintain robust customer engagement. One company at the forefront of this revolution is Connected Cars.

Connected Cars, with its suite of telematics solutions including ConnectedWorkshop and ConnectedFleet, is enabling dealerships to transform their service offerings and customer relationships. Their technology isn’t merely about the vehicle; it’s about crafting a seamless, integrated experience for the customer. With features like real-time vehicle diagnostics, maintenance alerts, remote software updates, and a branded app experience, dealers can provide value-added services that enhance customer loyalty and retention.

From transactional to relational: Redefining customer engagement

For instance, Connected Cars’ maintenance alerts are not just generic notifications. They are tailored, timely, and relevant, keeping the dealership and customer connected beyond the showroom. Services like ConnectedLeasing and their white-label Connected Cars app play a significant role in this regard, offering personalized interactions and real-time updates. This kind of proactive service approach can help dealerships shift from a reactive, transactional relationship to one that’s relational and engaged, even amidst the data access challenges posed by the agency model.

Moreover, Connected Cars’ solutions could be instrumental in navigating the data access conundrum. While manufacturers may gatekeep vehicle data, telematics services like ConnectedWorkshop provide an alternative data stream. This stream is consent-based and customer-centric. By leveraging this, dealerships can reposition themselves not just as vehicle sellers, but as comprehensive automotive service providers.

Overcoming challenges: The path to enhanced customer experience

However, this technological pivot isn’t without its challenges. Dealerships must negotiate for access to essential vehicle data. They need to advocate for regulatory frameworks that support data sharing for enhanced customer service, and invest in the necessary infrastructure to support these advanced telematics services.

In an era where customer experience is king, services like those offered by Connected Cars could be the key to unlocking a new level of customer engagement and loyalty for dealerships. By embracing these technologies, dealerships have the opportunity to redefine their value proposition and thrive in a rapidly evolving automotive ecosystem.

Conclusion: Navigating the new automotive landscape

The agency model signifies a profound shift in automotive retail, adjusting traditional dealership-manufacturer dynamics. While this introduces challenges like decreased autonomy and potential for reduced profits, it simultaneously presents opportunities for evolution. Solutions like those from Connected Cars harness technology to strengthen customer relationships. They become essential in maintaining customer connections potentially weakened by the new model.

Addressing the principal-agent challenge is critical. It necessitates proactive engagement from dealerships to ensure their interests align with those of manufacturers. This path is complex, yet filled with potential. Embracing technology, advocating for balanced partnerships, and uniting for a common cause can turn this transition into an opportunity for growth, innovation, and enduring success.

The automotive industry is steering towards uncharted territories. However, in this journey, the dealerships that anticipate change, adapt with agility, and advocate for their growth will be the ones that drive into a prosperous future.