Car supply shortage took its toll on the market globally in 2021. The supply of new cars will not be back to normal by 2022. Many are already beginning to feel the effects. Although importers, dealers, and suppliers are working hard to meet demands, people are waiting longer for their cars. In this article, we’ll introduce the issue and present actionable strategies for importers and dealers to get back on track.

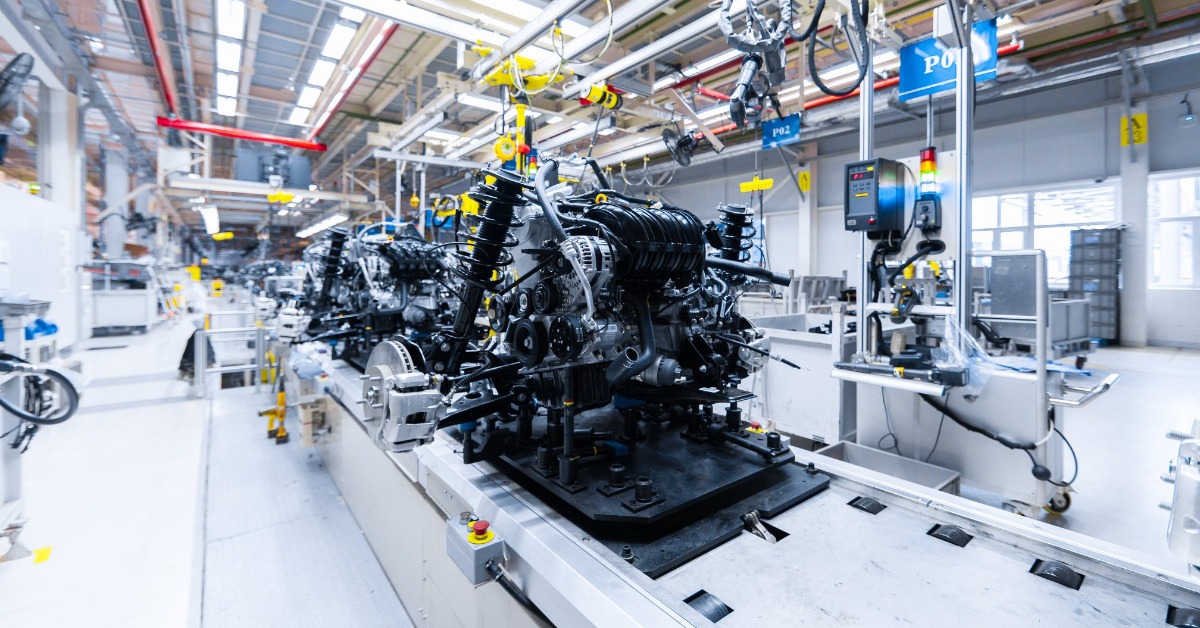

Car supply shortage globally. What’s the main cause?

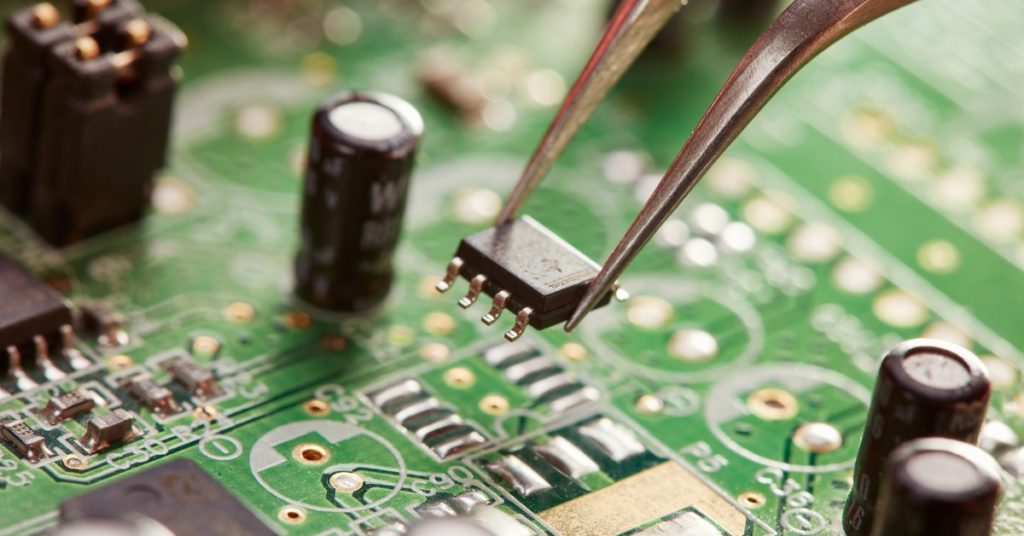

The number one reason for the current stagnation is the global semiconductor chip shortage. Since every module requires a semiconductor chip in a car, manufacturing stagnates. There are several reasons behind the current shortages. First, lack of new capacity, geopolitical tensions, overlapping demand due to the 5G rollout, and the factory shutdowns during COVID-19. Major OEMs already announced the rollbacks in their production. According to the consulting firm Alix Partners, the shortage will cause a $210 billion revenue loss for the auto industry.

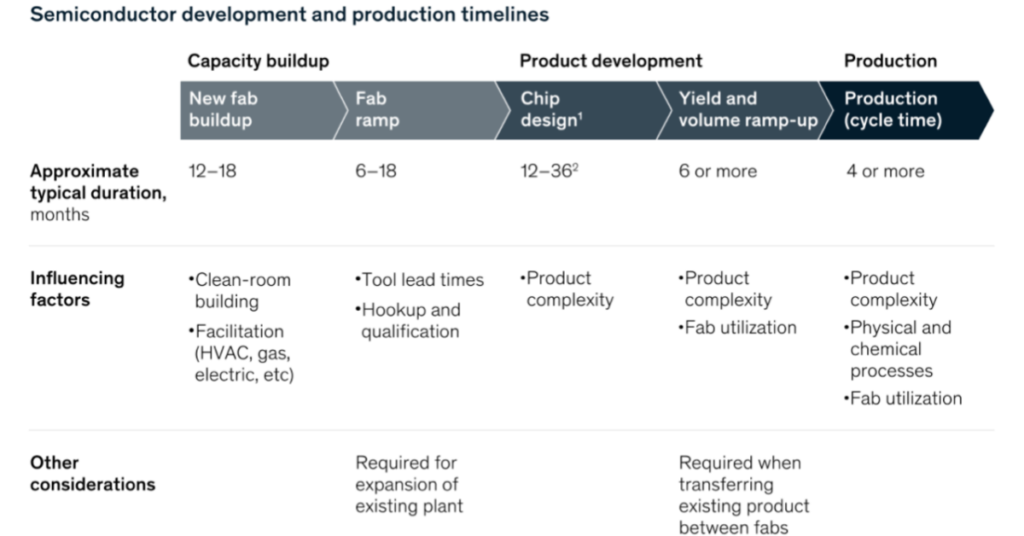

Secondly, demand for new cars is expected to rise up to 16% to almost 18.6 million units in Europe alone. It’s a rise but the auto industry will likely not be able to keep up with it. Experts say that the shortage will not likely resolve in the short term due to the complexity of the supply chain and heavy demand for chips from other industries. While the lead time for new semiconductors may take up to four months, switching to a new supplier takes up to a year. Hence, demand will not meet the supply soon and all players of the auto industry must think of new strategies to compensate for the revenue loss.

Semiconductor production timeline: The complexity makes it difficult to switch to a new supplier.

Source: McKinsey

What happens currently to the manufacturers & dealers

Back in May, one of the leading car industry trade SMMT warned that the car supply shortage starting in 2020 would likely be “a significant challenge” for the entire sector. That’s not surprising when we look at the intense competition between manufacturers and dealers to ensure the best prices for their customers. A few of the major carmakers have begun stockpiling parts, while others have invested in new production facilities. Still, the shortage affects all manufacturers, brands, and models. Dealers and under massive pressure as the cash flow is under pressure as the revenue is dropping from one month to another. Looking at reports from several dealerships globally, report that customers are waiting between 6 months and a year for their delivery. With the longer waiting periods, dealers are threatened to lose customers or have dissatisfied customers in the long run.

The President of Rochester Automobile Dealers Association said in September

“I’ve been in the car business for almost 40 years. This is probably the most widespread disruption to the manufacturing industry and auto industry that I’ve ever seen,” said Brad McAreavy.

“Without a doubt, this shortage is going to go well into 2022, at least the second half of ’22,” said Scott Keogh, Volkswagen Group of America’s CEO.

A solution for dealers and manufacturers: leveraging on the already existing assets, used cars

Luckily, it doesn’t mean the apocalypse is near but both importers and dealers should look into additional revenue streams until everything gets back to normal.

The 2 key focuses of both importers and dealers should be: customer loyalty and leveraging on used cars. The business case is much better on used cars because workshops deal with them in the same system: leasing, factory handling, service information, etc., and used cars need a lot more spare parts, and that’s where the business is.

Chief of Aftersales at Autocentralen, Finn Daugaard said: “We need both customer and car loyalty. We must be able to keep the customers and keep their used cars. Then, we the dealers sell it again and make its new owner loyal too.

Aftersales is so important for dealers like us. If you take a helicopter view of it, you will see on almost every dealer that ¾ of their turnover comes from sales, but ¾ of the profit comes from aftersales. Strong aftersales in the current situation is the best help you can give to your business.”

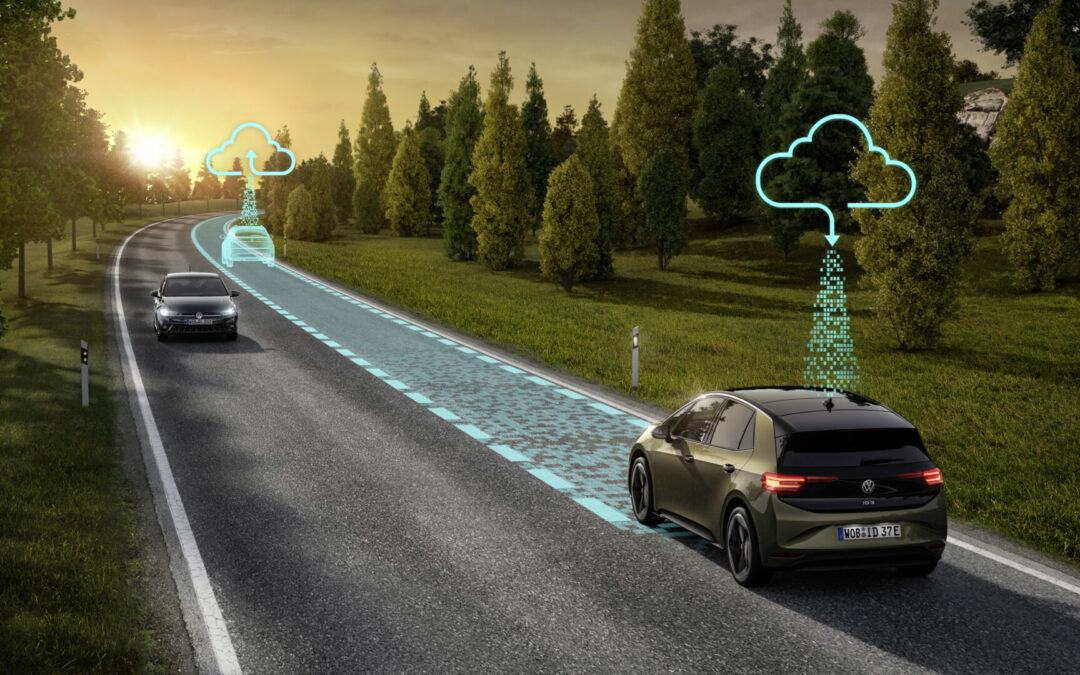

How connectivity can help the used car business?

To understand better why investing in aftersales will be the solution to the current problem, we must take a look at the relationship between car owners and dealerships. After the deal is done, car owners are bound by the warranty period to their designated authorized workshop. Workshops usually don’t have a close relationship with their customers, as customers only service their cars when a problem arises. Then, after the warranty period ends they go often and find a cheaper workshop to service their cars. This is a well-known phenomenon in the world of authorized dealers.

Luckily telematics and connected car technology can help the long-term customer loyalty problem. When a car is connected to its workshop, workshops can have a real-life overview of each car’s technical status. With this, workshops can foresee any future maintenance issues. Then they can have a proactive service approach: inform customers beforehand, book them in, and send them quotes. With such a proactive approach customers are inevitably becoming more loyal. When a used car owner becomes loyal that means continuously growing revenue for a workshop. The simple reason is, a used car needs a lot more service as the years go by, hence it’s crucial in the current car supply shortage to focus on retaining used cars as long as possible.

Conclusion

It’s clear that the current situation will not go away anytime soon and it needs a fast response from OEMs, importers, and dealers to minimize the massive revenue loss. At Connected Cars, we think that the best solution for the current problem is leveraging current assets, and used cars. Investing in aftersales is not only the long-term solution for the current car supply shortage but also for low customer retention that’s been plaguing the automotive industry for a long time.