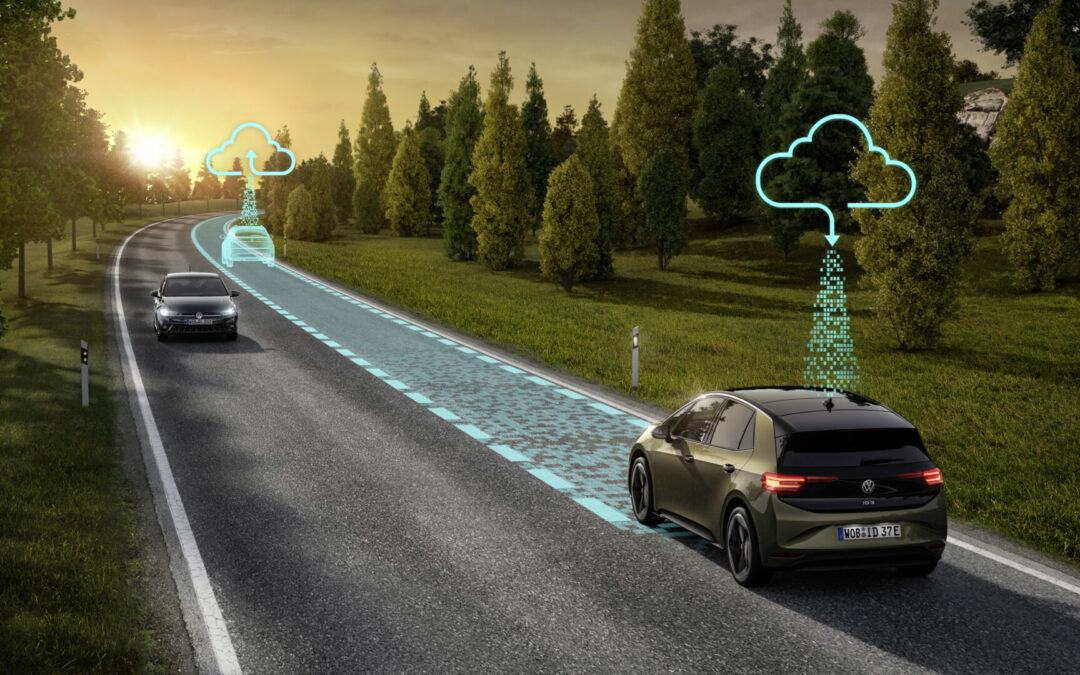

The connected car technology provides not only a unique customer experience but a unique opportunity for the whole ecosystem in the automotive industry. Its fuel, car data could be used in a myriad of ways, yet it’s still a huge untapped market. If we look at the world’s most valuable companies, 7 out of 10 already generate billions of profits from database services. Other traditional industries are also switching the hardware to software as a service (SaaS) business models. In this article, we’d like to show the 5 essential steps that could help the automotive industry players move faster on monetizing car data.

The potentials in connected car data

McKinsey’s consumer survey about connectivity from 2019 has shown for example that the respondents 61% in China or 54% from India would switch car brands for better connectivity. Additionally, 39 % of consumers were curious about getting more digital features after buying a car. Digital savvy consumers and rapidly changing customer expectations indicate the alarming importance of digitalization through the use of connected car data. OEMs that fail to move fast will risk losing customers, however considering these 5 essential points, may put them at the forefront of the new digital revolution:

Use car data to boost customer experience

Consumers are used to a fully digital world and they expect full connectivity, even in their cars. Customer service and dialogue with brands are expected to be fast, easy, and personalized. When it comes to service, maintenance, and driving experience, the same principles apply; an overall 360-degree digital experience.

The industry still has a lot to do on this side. Despite the huge potential, many OEMs are behind on using car data to enhance customer experience. Many still lack interconnected devices and services consequently lack continuous interaction with their customers. Few customers extend connected-service packages, not to mention that customer retention is also plummeting. On the contrary EV, OEMs have noticed the problem and made an effort to build in customer feedback with a short reaction time. Some OEMs are slowly getting alert and start making value from connected-car data by developing better infotainment solutions and apps. There’s still a long way to go to a fully customer-centric approach, but there has been a shift towards it.

Use data to respond to regulation and security requirements

Personal data protection has become an increasingly important issue. Instead of slowing down the pace of leveraging connected car data, OEMs could use the new guidelines. The EU has a much more thorough guideline (GDPR) compared to the U.S, so OEMs located on the continent can get better legal security. This creates a market advantage where European car manufacturers are much more likely to use services that involve third consumer data.

Make firm long term investments while setting short-term profits

A dual approach to the business can be the winning approach. Players in the whole ecosystem from OEMs to dealers and suppliers must make their core business profitable in the short run. On the other hand, they must be willing to invest in new technologies for the future. With the increasing regulations of internal combustion engines (ICE) mastering electric vehicle (EV) technology and realigning the whole ecosystem for that is key. Connected car data will play a key role in the new era of EVs. Workshops are threatened to lose a significant amount of their revenue due to the different EV maintenance, but predictive car data is part of the solution. Workshops need to be fast movers and adaptors to the change and make customer loyalty key for their business. Connecting customers to the workshops has proven to strengthen customer loyalty and consequently resulted in higher revenue.

Connecting cars to the dealerships/workshops will inevitably lead to higher customer retention since around 1/3rd of customers would change car brands to have better connectivity.

Focus on collaboration with the ecosystem for better turnover

New companies bring innovation to the traditional automotive sector and these players should be taken very seriously.

The industry already started to move towards the monetization of the full ecosystem rather than focusing on one segment. Many recent consumer trends signal this rapid shift: online car sales will increase by 20 to 25 % by 2025. Also, subscription models will become very popular. These shifts highlight the importance of the life-cycle perspective and connectivity will be the glue among them. OEMs, suppliers, and dealers can monetize connected car data in many ways. Partnership with insurance companies and other mobility players are additional ways to leverage car data.

Leverage on the opportunities of the newest technologies

Forecasts show that connectivity levels will increase significantly by 60-70% of the new cars sold in Europe and North America. Based on McKinsey’s Connected Car Experience framework, these cars will reach level 3 by 2030. This means that these newly manufactured cars’ systems will be intelligent and predictive by default. It includes better E/E architecture, improved sensors including cameras and light detection, and highly increased interconnectivity. This is a massive improvement in a traditionally slow-mover industry.

The forerunners of this development are EV OEMs. Several of them operate as suppliers of software development for infotainment that others typically outsource.

Other innovative tech companies are becoming the default provider of infotainment, mostly among OEMs in the EU and NAFTA. Next to tech companies other sectors such as telco, media agencies, and retail outlets enter the ecosystem either as data users or suppliers.

In the light of these shifts, OEMs should define what they’ll manufacture themselves versus what they’ll outsource. Collaboration with the best companies’ top-notch technologies will be a must to gain the most out of the new era.

Conclusion

With the utilisation of car data, the automotive industry is going through a revolution. Data can show us rich information about a car, from its technical conditions to handling or usage. With this, the workshop’s approach to customer service can be changed drastically too. Car data can and will have a huge impact on the whole ecosystem. Although the progress of adaptation is still slow, all developments point toward future acceleration. Leveraging on the data will not only provide additional revenue streams but also a better customer experience.